Climate change dramatically shifts infrastructure needs toward infrastructure that is climate-resilient and that supports emission reduction targets under the Paris Agreement. Meeting the Sustainable Development Goals (SDGs) by 2030 will also require realizing significant increases in economically, environmentally and socially sustainable investments across multiple sectors.

As a major contributor to global greenhouse gas (GHG) emissions, Asia’s sustainable development pathway will be crucial for achieving the Paris Agreement objectives.

Increasing attention and commitment of our members and clients to adapt to and mitigate the impact of climate change and address local environmental problems have reinforced the need for AIIB to focus on this area.

Aside from working with other MDBs to increase our combined climate financing to USD175 billion by 2025, we’re making our own efforts to combat climate change through our investments.

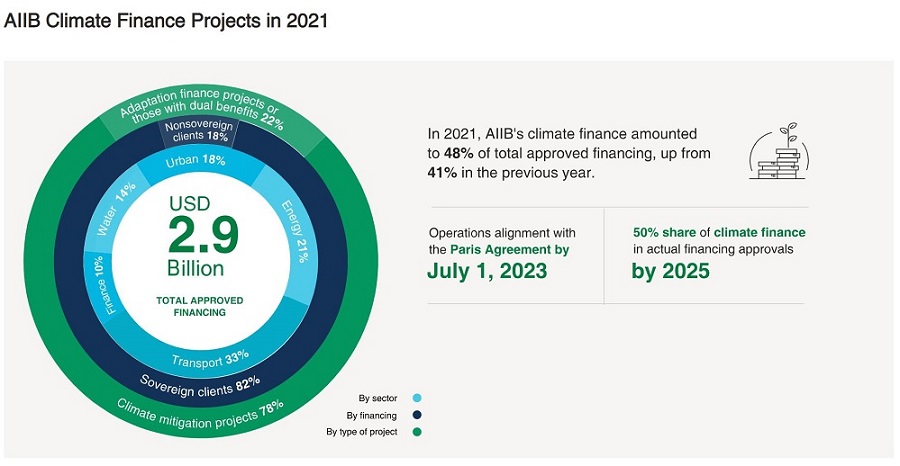

Reflecting our commitment to support the Paris Agreement, AIIB has set an ambitious target of ensuring that 50 percent of overall approved financing by 2025 will be directed toward climate finance. We announced on Oct. 26, 2021 that we would align our operations with the goals of the Paris Agreement by July 1, 2023. Our current estimate is that our cumulative climate finance approvals would be USD50 billion by 2030.

In 2021, AIIB’s climate finance amounted to USD2.9 billion, or 48 percent of total approved financing, up from 41 percent in the previous year. Of the total climate financing, climate mitigation projects—such as renewable energy, energy efficiency and urban public transport—received 78 percent, with the remaining 22 percent being adaptation finance or having dual benefits. The vast majority (82 percent) of climate financing was approved to sovereign clients, while the balance was approved to private sector and municipal government clients. Transport sector projects contributed the highest share (33 percent), followed by energy (21 percent), urban (18 percent), water (14 percent) and finance (10 percent).